Can Full Loan Cover Buy Car Expenses in Malaysia

Paycheck stubs from the previous 3 months. In general national and second-hand cars have higher interest rates.

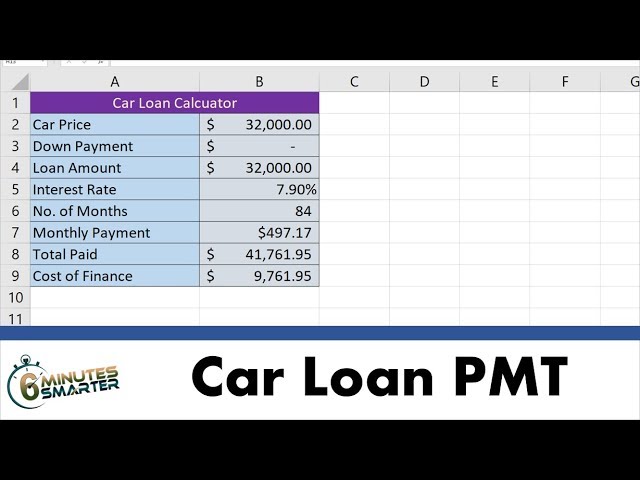

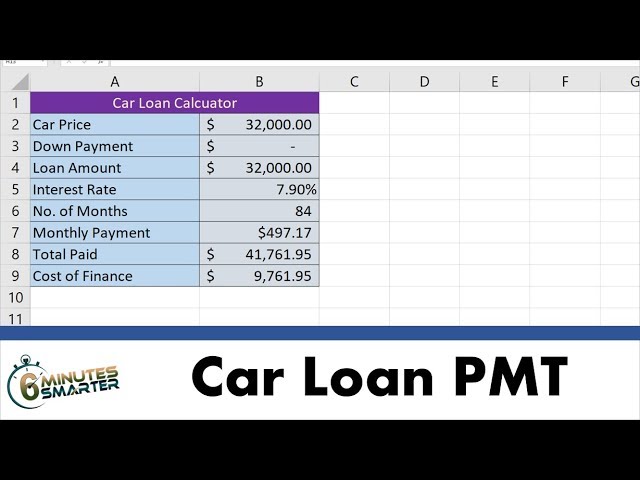

Use The Pmt Function To Calculate Car Loan Payments And Cost Of Financing Youtube

Their annual gross income would amount to RM30000.

. Apply for car insurance. For instance if you are a government servant you can choose to apply for a koperasi loan of RM52600 full car price to finance your car. This is how it works.

Depending on where the car was bought Peninsular or East Malaysia type of vehicle ownership private or company and engine capacity road tax is one mandatory cost that you are unable to escape from. Its simple maths. 35 x RM 70000 x 5 RM 12250.

Register the car with the Road Transport Department. The cost of owning a car in Malaysia extends well beyond the purchase price. Apply for road tax.

Lets use the average starting salary of a fresh graduate for example RM2500 in most industries. The Rule of 78 allows banks to load 80 percent of the total interest payable onto the first half of the loans tenure thus assuring them a fat profit when a borrower decides to make an early settlement. Monthly Interest RM 12250 5.

For a Persona of 16cc in Peninsular Malaysia the road tax rate is RM9000 a year. The estimated cost of ownership over 3 years is RM17381 this calculation is based on the assumption that the car mileage does not exceed 20000 km a year. Buying third party car insurance is compulsory in Malaysia if you own a car.

A loan is paid off over time and in Malaysia you can take out a car loan for a minimum of one year to a maximum of nine years. For an expat to apply for a loan they should make sure they have these documents. The car you can afford to buy is the one with a price thats equivalent or less than your monthly gross salary x 12 months.

We talked to a few banks about the eligibility of expats for personal loans in Malaysia housing loans and car loans as well as credit card applications. Youll have to cover monthly or annual expenses such as road tax insurance maintenance parking tolls and of course petrol. You must have Driving License Pay slip and Guarantor to get better interest rate for car loan in Malaysia.

Procedure To Appy Loan To Buy A Car in Malaysia is a bit complicated. The rule of thumb to buy a car in cash is if you are buying a used car which does not require you to pay a lot more than the amount you trade in your current car for. Most of the used car dealership would usually charge a processing fee that can go up to RM 5000 to cover.

You pay a downpayment minimum 10. If you do not own third party car insurance you will not be able to renew your vehicles road tax from Road Transport Department JPJ Malaysia. The interest for car loan was 76 at that time very high but lower than few months before I took the loan.

But you have to be reminded that with a hire purchase loan if you fail to pay your monthly instalments on time your car can be repossessed by the bank. You can ask for your grant back earlier after one year of full and precise repayments. The car loan application process.

Besides that you can do this if you have enough cash to spare. Whats the cost of owning a car in Malaysia. Interest rates apply to all types of loans and naturally car loans are no exception.

Then you decide how you want to pay. With a valid visa and a decent credit rating most expats are able to get loans from a Malaysian bank. Income Tax Act 1967 Schedule 3 stated clearly that the maximum qualifying expenditure for a private vehicle not licensed on a commercial basis is RM50000 RM100000 if the purchased vehicle is a new vehicle and its value is less than RM150000 this is why everybody believe register private vehicle under company name will save their tax.

Using four different travelling scenarios differentiated by distance travelled per. That amounts to RM450 over five years. 44 70 depending on loan package If youre looking for specific loan packages that fit your needs you should check out the vehicle financing options that Bank Muamalat offers.

Here is the car loan procedure and the required document for you to buy a new car or a used car from the car seller. For instance you want to buy a shop lot that costs RM17 million. The maximum value of a car that can be purchased is RM 6750 based on the calculation of vehicle loans.

The truth is unless you are buying a Mercedes-Benz in cash normal vehicles are off the radar. Here is how your total interest monthly interest and monthly installment will be calculated based on the formula above. But as per Tip 1 this does not take into consideration all expenses incurred when buying a car.

The figure below illustrates rough monthly expenses if we pay RM900 a. But you can settle your car loan early and earn interest from FD and rebate from bank by Full Settlement I financed RM20000 to buy a Proton Saga in 1999. 18 20 depending on loan package Maximum Age.

Below is a summarised diagram of a typical car loan application process in Malaysia. Lets circle back to the same example where your car loan is at RM70000 with an interest rate of 35 percent and a five-year loan period. While these costs can vary you can see a breakdown of estimated costs of owning a car in.

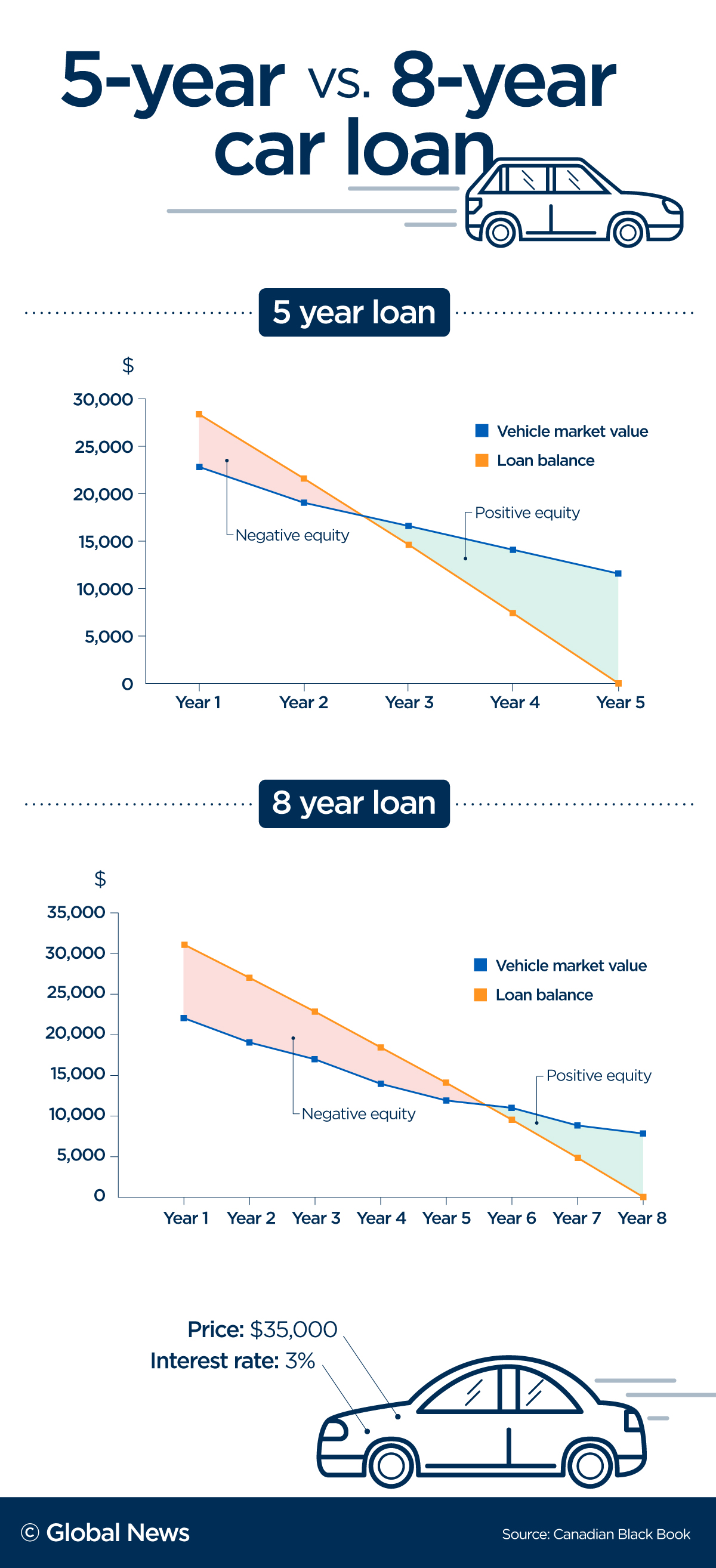

You can get a bank to finance up to 70 RM119 million while you come up with the balance RM510000 minus other fees. Buying a car with a 9-car loan is a bad idea. First you choose the car you want to buy.

The car dealer will give you a list of banks to choose from. Ad Get Pre-Approved To See Your Real Terms For Every Vehicle. To ensure you qualify for a car loan you have to be sure that you provide all the necessary documents for your application.

The salary is RM900 per month and 15 of the salary is RM135 per month. Apply for a loan if you need to. Malaysia like other countries in the region has a very common hire purchase concept.

The rates set for car loans are partly based on 2 main vehicle-related factors firstly if it is a national or foreign-made brand and second if it is a new or used car. Unless you have RM 60000 lying around to pay the bank in full used car dealerships are your next option because they would have the option to settle off your loan in full. Once the application and documents are submitted it is up to the bank to decide on the approval of.

If you have to take a 9-year loan for your car it means you cant afford. Driving without a valid road tax can cost you penalty in fines up to RM3000 depending on courts decision. Lets say you are buying a car that costs RM40000 and put down the minimum down-payment of 10 which is RM4000.

This includes the depreciated car value insurance road tax and service but excludes petrol expenses. In most cases you will get a hire purchase loan from the bank. The requirements are similar to those of a loan from an American institution.

Pre-qualified Shoppers See Real Terms And Actual Monthly Payments For Every Vehicle. 3 The seller manages all of the paperwork in the process including arranging delivery of the car.

How Do I Qualify For A Car Loan Experian

Using A Car As Collateral For A Loan Self Inc

Auto Loan Calculator Free Auto Loan Payment Calculator For Excel

Your Car Loan Payment May Be Way Too High Here S What S Happening National Globalnews Ca

Comments

Post a Comment